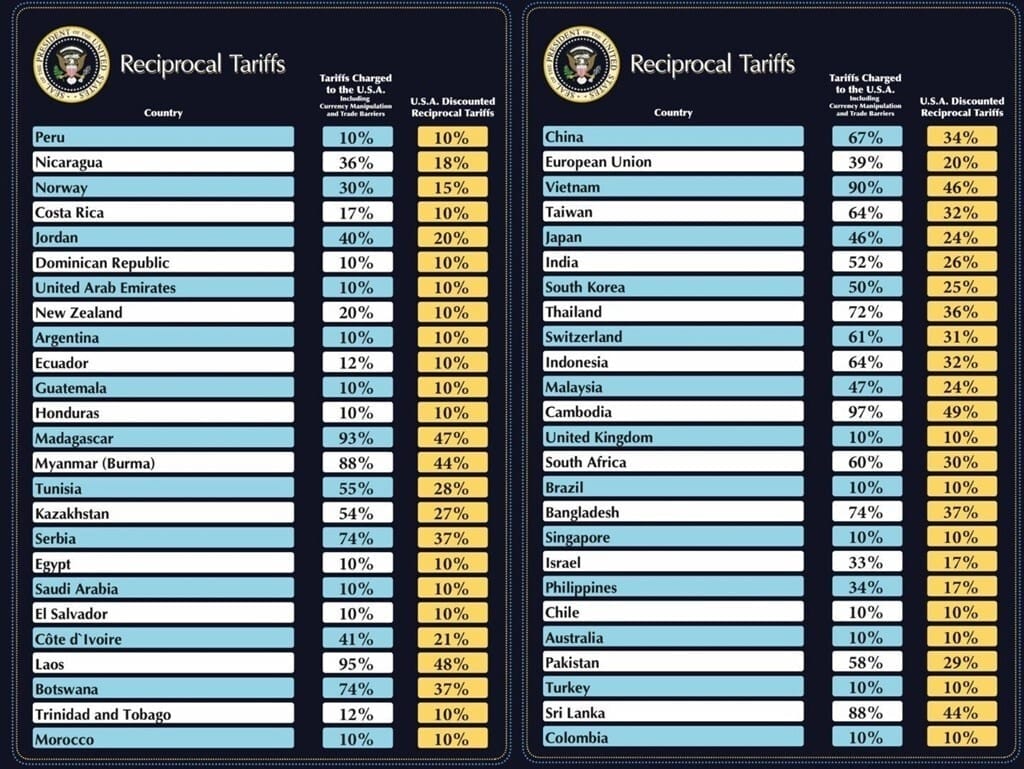

USA imposes 26% reciprocal tariffs on India

India was slapped with a reciprocal tax by the United States on Wednesday, as President Donald Trump raised trade barriers on all goods entering America.

A flat 26 per cent tariff was imposed on all goods being exported by India to the United States, amidst reciprocal tariffs in the range of 10% – 49% unveiled by Trump for other countries.

The United States imposes a 2.5 per cent tariff on passenger vehicle imports, while India imposes 70 per cent, the White House said in a statement.

Apples are allowed to enter US duty free, but India imposes 50 per cent duty on US apples coming in to India, while rice attracts 2.7 per cent in US, in India it is at 80 per cent.

On networking switches and routers, the United States imposes a 0% tariff, but India levies higher rates 10-20 per cent, the statement added.

The US has a trade deficit of $46 billion with India.

Which sectors will be impacted?

All these sectors will be hit with a blanket reciprocal tariff of 26 per cent.

These include Meat, fish, and seafood; Processed food, sugar, and cocoa; Cereals, vegetables, fruits, and spices; Dairy products; Edible oils; Diamonds, gold, and silver;

Electrical, telecom, and electronics; Chemicals (excluding pharma); Textiles, fabrics, yarn, and carpets; Rubber products, including tyres and belts; Ceramic, glass, and stone products; Footwear; and automobile and auto components.

1. Electronics Exports (~$14 billion annually)

India exports a large volume of consumer electronics, such as smartphones, circuit boards, and related components, to the U.S.

With a 26% tariff, Indian electronics will become significantly more expensive in the U.S. market, making them less competitive compared to goods from countries like Vietnam, South Korea, or Mexico.

This is expected to hurt Indian manufacturers and exporters, especially in states like Tamil Nadu and Karnataka that house major electronics hubs.

A BBC said that India’s electronics sector may benefit from this new tariff policy as steeper duties on countries such as Vietnam may trigger some re-routing of the business.

2. Gems & Jewellery (~$9 billion annually)

India is one of the world’s leading exporters of polished diamonds, gold jewelry, and handcraft ornaments.

These items are price-sensitive luxury goods, and a 26% tariff could significantly reduce demand from U.S. retailers and consumers.

Small and medium enterprises (SMEs), especially in Gujarat and Maharashtra, could face loss of orders, reduced margins, and potential layoffs.

3. Auto Components and Aluminium

The auto parts industry automotive supply chains. from precision components to castings is deeply integrated with U.S.

Trump’s policy includes an extra 25% tariff on aluminum, which affects India’s exports of semi-finished aluminum products and parts.

Indian suppliers could lose out to competitors in tariff-free or low-tariff countries (e.g., Canada, Mexico), threatening thousands of jobs.

4. Pharma Sector: The Big Winner

Exemption from Taxes:

Pharmaceutical exports (valued at ~$6.5 billion to the U.S.) have been exempted from the 26% tariff.

This is because the U.S. relies heavily on affordable Indian generics, which are critical to its healthcare system.

Following the announcement, Indian pharmaceutical stocks rose by 5%, reflecting investor confidence.

This could strengthen India’s image as the “pharmacy of the world,” and potentially open up more B2B contracts with U.S. drug distributors and hospitals.

In a statement after the Rose Garden ceremony, the White House that certain commodities have been kept out of the tariff ambit that will kick in from April 5.

These include semiconductors, lumber articles, copper and gold apart from pharma products.

The list also includes energy and certain minerals that are not available in the US.

At present, India charges 10% tariff on American pharma imports.

In terms of trade, India imports pharma products worth nearly $800 million from the US, while exports to the country are worth $8.7 billion.

Indian Government’s Reaction

Diplomatic Response:

India has begun bilateral discussions to defuse trade tensions and avoid a full-blown trade war.

The Ministry of Commerce has proposed:

Lowering tariffs on select U.S. agricultural goods like almonds, walnuts, apples, and dairy.

Reducing duties on U.S. liquefied natural gas (LNG) imports, potentially as a bargaining chip to offset Trump’s measures.

Goal:

India is signaling its willingness to negotiate but without appearing weak. It seeks to maintain strategic autonomy while protecting key industries and workers.

Economic Impact Projections

GDP Impact:

According to independent analysts and think tanks, India could see a GDP contraction of 0.72% due to the tariffs.

That translates to roughly $31 billion in potential economic losses, considering trade disruptions, job losses, and reduced business investments.

Trade Balance & Currency Pressure:

India’s current account balance could worsen if exports fall and U.S. investments slow.

The Indian Rupee may face devaluation pressure, especially if foreign investors perceive India as becoming less competitive globally.

Strategic Implications for India

Short-Term:

Exporters will feel the squeeze, especially SMEs that cannot quickly diversify their market base.

Expect job losses in manufacturing-heavy sectors.

Medium to Long-Term:

India may look to diversify exports toward the EU, Southeast Asia, and the Middle East.

Government may roll out export incentives or subsidies to help businesses cope.

There may be a push for free trade agreements (FTAs) with other regions to reduce dependency on U.S. trade.

You may refer to Study IQ video for the same

More such articles are there on our website here